Who is Eligible for Medicare and When Should You Apply?

Author: Home Helpers® Home Care

Medicare is an essential health insurance program, but not everyone knows when or how to enroll. Missing deadlines can lead to costly penalties and delayed coverage. So, who is eligible for Medicare, and when is the right time to sign up for Medicare?

🎥 This is the third episode in a seven-part Medicare series on Home Helpers Water Cooler Chat. It features Medicare expert Scott Black, the owner of Florida Health Resources. In this episode, Scott explains who is eligible for Medicare and how to enroll without penalties.

📌 Looking for expert Medicare guidance? Contact Scott Black for personalized assistance.

📞 Call or Text: (941) 302-0314

📧 Email: sdblack@verizon.net

🏢 Company: Florida Health Resources

Who is Eligible for Medicare?

Medicare eligibility depends on age, disability status, or specific medical conditions. You qualify if you meet any of the following conditions:

✅ Turning 65?

- If you are a U.S. citizen or permanent resident, you can get Medicare starting the first day of your birthday month

- If your birthday is on the 1st of the month, your Medicare eligibility begins the month before.

✅ Retiring from an employer plan?

- You can delay Medicare enrollment without penalties if your company has 20 or more employees. However, you must have Medicare-creditable employer coverage.

- Does your employer have fewer than 20 employees? Then you must enroll in Medicare Part A and Part B as soon as you’re eligible to prevent penalties.

✅ Under 65 with a disability?

- You qualify if you’ve received Social Security Disability Insurance (SSDI) for at least 24 months.

- Medicare automatically begins in the 25th month.

✅ Diagnosed with ALS or End-Stage Renal Disease (ESRD)?

- ALS (Lou Gehrig’s disease): You qualify for Medicare immediately upon receiving SSDI—no 24-month waiting period.

- ESRD (kidney failure requiring dialysis or transplant): You qualify, but eligibility depends on your treatment timeline.

Understanding Employer Coverage & Medicare Eligibility

If you're still working at age 65 and have employer-sponsored health coverage, you may wonder whether to enroll in Medicare or delay it.

💡 Key Employer Size Rules for Medicare Enrollment:

- If your employer has 20 or more employees:

You can delay enrolling in Medicare Part B and Part D without a penalty. However, your employer coverage must be Medicare-creditable. Always check with HR to confirm that your coverage meets Medicare’s standards.

- If your employer has fewer than 20 employees:

You must enroll in Medicare Part A Hospital Insurance & Part B when first eligible to avoid late penalties. In this case, Medicare becomes your primary insurance, meaning your employer plan will only pay after Medicare.

Note: Not sure if your employer plan is Medicare-creditable? A Medicare broker, like Scott Black, can help you determine the right time to enroll.

When Should You Apply for Medicare?

You have a 7-month Initial Enrollment Period (IEP) when turning 65. This window includes:

- 3 months before turning 65 → Best time to enroll to ensure your benefits start on time.

- Month of your 65th birthday

- 3 months after your birthday month → If you enroll late, your coverage could be delayed.

Warning: If you miss this window, you could face lifelong late enrollment penalties.

Applying for Medicare After Age 65

If you delayed Medicare because of employer coverage, you have a Special Enrollment Period (SEP) once your employment ends:

- You have 8 months to enroll in Medicare Part A & Part B without facing a late penalty.

- You have 63 days to enroll in Medicare Part D (prescription drug plans) after your employer coverage ends. If you miss this deadline, you may face a penalty.

Tip: Uncertain about your enrollment period? A Medicare broker helps you apply at the right time.

Late Enrollment Penalties: What You Need to Know

Missing Medicare enrollment deadlines can result in lifelong late penalties that increase your monthly premium costs:

1.❌ Part B Late Penalty – Your monthly premium increases by 10% for every 12- month period you delay enrolling. This penalty stays with you for life as long as you have Medicare Part B.

2.❌ Part D Late Penalty – You will pay a 1% penalty per month for not having creditable prescription drug coverage when first eligible.

- The calculation of the penalty depends on the national base premium. This premium amount changes each year.

- The estimated base premium for 2025 is about $34–$35. Your penalty will increase the longer you go without drug coverage.

3.❌ General Enrollment Period Consequences – If you miss your Initial Enrollment Period, you cannot enroll right away. You must wait until the General Enrollment Period (Jan 1 – Mar 31) to sign up.

- Your coverage won’t begin until July 1st, leaving you without insurance for months.

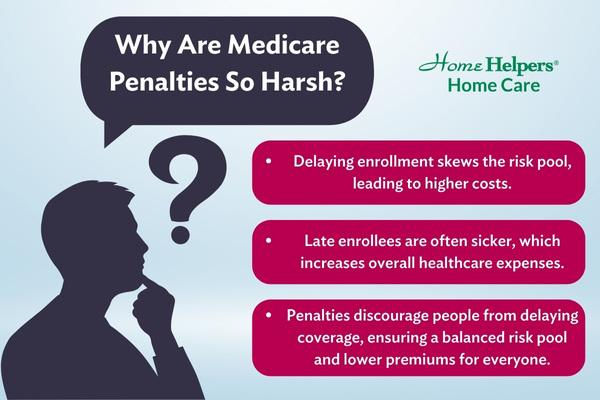

Why Are Medicare Penalties So Harsh?

Medicare relies on timely enrollment to keep premiums affordable for all beneficiaries.

TIP: Want to avoid penalties? A Medicare broker like Scott Black ensures you enroll on time.

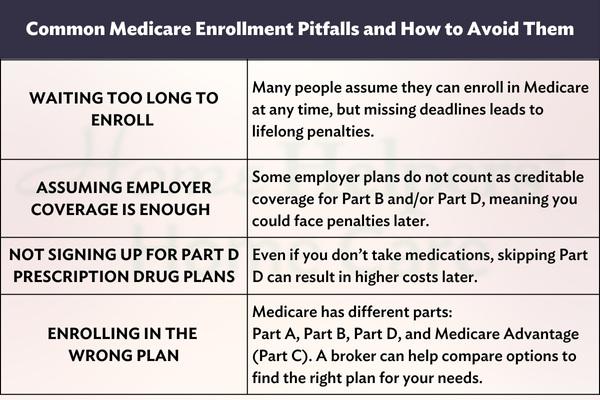

Medicare Enrollment Mistakes to Avoid

Avoid costly mistakes when enrolling in Medicare. Use this table to learn common pitfalls and how to prevent them.

How a Medicare Broker Helps You Enroll on Time

A Medicare broker helps you navigate the enrollment process, avoid penalties, and find the right coverage. Brokers provide:

- ✅ Personalized Guidance – They help you determine when to enroll based on your situation.

- ✅ Plan Comparisons – Brokers compare multiple health insurance companies to find the best plan for you.

- ✅ Penalty Prevention – A broker ensures you don’t miss deadlines that result in extra costs.

- ✅ Prescription Drug Coverage Reviews – They check that your plan covers all necessary medications.

- ✅ Ongoing Support – Brokers assist before, during, and after Medicare enrollment.

Do you need help understanding Medicare? A broker like Scott Black helps you enroll without stress or penalties.

Final Thoughts: Don’t Wait to Enroll in Medicare

If you’re turning 65 or leaving employer coverage, enroll in Medicare on time to avoid penalties. Waiting too long can increase costs and leave you without coverage for months.

🎥 Want to learn more? Watch the full Medicare series with Scott Black to understand your options.

📞 Need Help? Contact Scott Black at Florida Health Resources for free, personalized Medicare guidance!

✅ Call or Text: (941) 302-0314

✅ Email: sdblack@verizon.net

HOME HELPERS OF BRADENTON

Home Helpers of Bradenton is one of the region's leading home care franchises specializing in comprehensive services for seniors. Home Helpers' sole mission is to make life easier for clients and their families. Based in Bradenton, Florida, the company serves all of Manatee County, including the communities of Anna Maria, Bradenton, Bradenton Beach, Ellenton, Holmes Beach, Lakewood Ranch, Longboat Key, Palmetto, and Parrish. For more information or to request a free in-home care assessment, contact our office at (941) 499-5946 or visit our website at www.homehelpershomecare.com/bradenton