Medicare Supplement (Medigap) Plans: What You Need to Know

Author: Home Helpers Home Care

Medicare provides coverage for many healthcare services. However, it does not provide full coverage for all services. Without extra coverage, you may face high out-of-pocket costs. A Medicare Supplement (Medigap) plan can help lower these expenses.

🎥 This is the fourth episode in a seven-part Medicare series on Home Helpers Water Cooler Chat. It features Medicare expert Scott Black, the owner of Florida Health Resources. In this episode, Scott explains what Medigap plans cover and how they work.

📌 Looking for Medicare guidance? Contact Scott Black for expert, personalized assistance.

📞 Call or Text: (941) 302-0314

📧 Email: sdblack@verizon.net

🏢 Company: Florida Health Resources

What is a Medicare Supplement (Medigap) Plan?

Medicare Supplement (Medigap) plans help cover costs not included in Original Medicare (Parts A & B). Medicare covers many healthcare costs, but you still need to pay deductibles, copayments, and coinsurance. That’s where Medigap plans come in—they help pay your share of the costs that Medicare doesn’t cover.

What Do Medigap Plans Cover?

- Medicare Part A deductible – Helps pay hospital-related costs before Medicare coverage begins.

- Medicare Part B coinsurance & copayments – Reduces your doctor visit costs.

- Skilled nursing facility coinsurance – Covers additional expenses for extended care.

- Foreign travel emergency care – Provides limited emergency coverage outside the U.S. for some Medigap plans.

💡 Medigap plans work alongside Original Medicare (Parts A & B). You keep your Medicare coverage, but Medigap helps reduce your out-of-pocket costs.

What Medigap Plans Don’t Cover

While Medigap helps with healthcare expenses, it does not cover:

- Prescription drugs – You need a Medicare Part D prescription drug plan for medication coverage.

- Vision, dental, and hearing – Routine exams, glasses, and hearing aids are not covered.

- Long-term care – Extended nursing home stays are not included.

- Private-duty nursing – Home healthcare beyond what Medicare covers requires separate insurance.

💡 A Medicare broker like Scott Black can help you compare Medigap plans and find the best option for your needs.

Medicare Plan F vs. Plan G: Which One is Better?

Medigap plans are standardized, meaning they offer the same benefits across all insurance companies. The two most popular plans are Plan F and Plan G.

• Plan F – This plan pays 100% of Medicare out-of-pocket costs. However, it is not available to people who became eligible after January 1, 2020.

• Plan G – Covers everything Plan F does, except for the Medicare Part B deductible (which was $240 in 2024 but may increase in 2025).

• Plan G Premiums – Generally lower than Plan F, making it a more affordable long-term option.

💡 Plan G is now the most popular Medigap plan for new Medicare beneficiaries.

Other Medigap Plans to Consider

If Plan G isn’t the right fit, other options include:

• Plan N – Covers everything except the Part B deductible and excess charges.

• High-Deductible Plan G – Lower monthly premiums but require you to pay a $2,800 deductible before benefits start.

• Plan K and Plan L – Cover only a percentage of out-of-pocket costs but have lower premiums.

💡 If you’re unsure which Medigap plan suits your needs, a Medicare broker can assist you. They will compare your options and help you find the best fit.

Who Should Choose a Medigap Plan?

Medigap plans are ideal for people who:

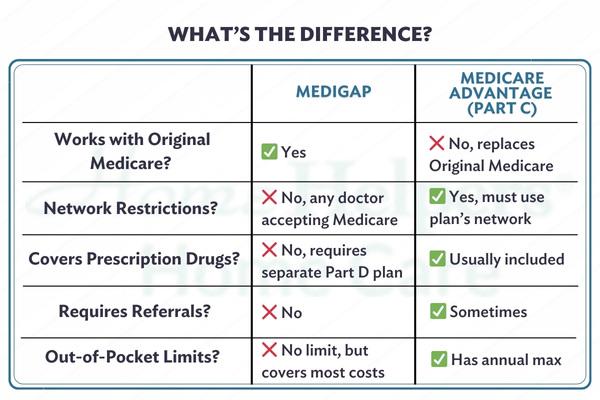

• Want nationwide coverage – Medigap plans work with any doctor that accepts Medicare, with no network restrictions.

• Travel frequently – If you travel within the U.S. or abroad, Medigap provides flexibility without worrying about network limitations.

• Want predictable healthcare costs – Medigap provides lower, more predictable costs instead of unexpected bills.

• Don’t want a Medicare Advantage plan – Medigap works differently from Medicare Advantage. It does not require referrals or restrict you to HMO/PPO networks.

• Need coverage beyond Original Medicare – Medigap helps with hospital stays, doctor visits, and skilled nursing facility care.

💡 A Medigap plan can help if you prefer stable healthcare costs. It also allows you to visit any doctor who accepts Medicare.

Medigap vs. Medicare Advantage: What's the Difference?

💡 A broker can help you decide whether Medigap or Medicare Advantage is the best choice based on your healthcare needs.

When to Enroll in a Medigap Plan

You can sign up for Medigap at any time, but the best time is during the Medigap Open Enrollment Period (OEP):

• It begins the first month you have Medicare Part B and are 65 or older.

• Lasts for six months – During this time, you can enroll in any Medigap plan without health screenings or medical underwriting.

• If you apply later, insurers can charge higher premiums or deny coverage based on pre-existing conditions.

💡A Medicare broker ensures you enroll on time and avoid extra costs.

Final Thoughts: Is a Medigap Plan Right for You?

If you want lower out-of-pocket costs and the freedom to see any doctor who accepts Medicare, a Medicare Supplement (Medigap) plan might be the best choice. Medigap provides predictable costs, nationwide coverage, and flexibility that Medicare Advantage plans do not offer.

Why Work With a Medicare Broker?

A Medicare broker like Scott Black helps:

• Compare Medigap plans from different insurance companies.

• Explain the differences between Plan G, Plan N, and other options.

• Ensure you enroll at the right time to avoid higher premiums.

• Find the best coverage for your healthcare needs.

🎥 Want to learn more? Watch the full Medicare series with Scott Black to understand your options.

📞 Need Help? Contact Scott Black at Florida Health Resources for free, personalized Medicare guidance!

✅ Call or Text: (941) 302-0314

✅ Email: sdblack@verizon.net

HOME HELPERS OF BRADENTON

Home Helpers of Bradenton is one of the region's leading home care franchises specializing in comprehensive services for seniors. Home Helpers' sole mission is to make life easier for clients and their families. Based in Bradenton, Florida, the company serves all of Manatee County, including the communities of Anna Maria, Bradenton, Bradenton Beach, Ellenton, Holmes Beach, Lakewood Ranch, Longboat Key, Palmetto, and Parrish. For more information or to request a free in-home care assessment, contact our office at (941) 499-5946 or visit our website at www.homehelpershomecare.com/bradenton