How a Medicare Broker Can Help You Choose the Right Plan

Author: Home Helpers Home Care

Navigating Medicare can be overwhelming. With so many plans and options available, how can you be sure you're making the right choice? Professional guidance from a Medicare broker makes choosing a plan easier!

🎥 This episode marks Part 2 of the 7-part Medicare series on Home Helpers Water Cooler Chat. It features Scott Black, a Medicare specialist and the owner of Florida Health Resources. In this episode, Scott describes how a Medicare broker works and helps individuals find the best plan for their needs.

📌 Need Medicare guidance? Contact Scott Black for personalized help!

📞 Call or Text: (941) 302-0314

📧 Email: sdblack@verizon.net

🏢 Company: Florida Health Resources

What is a Medicare Broker?

A Medicare broker is a licensed insurance professional who simplifies the process of choosing a Medicare plan. They help match you with a Medicare Advantage, Medicare Supplement (Medigap), or Part D prescription drug plan that best fits your needs.

Captive agents sell plans from just one insurance company. Brokers, however, compare plans from multiple insurance companies to provide more Medicare options. However, brokers can only provide plans from the insurance companies they have contracts with, which may limit available options. This means they might not present every plan available in your area.

Brokers give you more choices than captive agents. However, always ask which insurance companies they represent to ensure you have access to a variety of plans.

How a Medicare Broker Differs from an Insurance Agent

Many people confuse Medicare brokers with insurance agents, but there’s a key difference:

The services of Medicare brokers are not entirely free. Instead, they earn commissions from insurance companies when you enroll. However, their services do not increase your premium or cost you anything directly.

Why Use a Medicare Broker?

Many people try to navigate Medicare alone or call a 1-800-number agent from a TV commercial. Unfortunately, this can lead to:

❌ Confusion

❌ Unexpected costs

❌ Coverage gaps

A Medicare broker provides:

- ✅ Personalized Plan Research – They review your doctors, prescriptions, and preferred hospitals to make sure your chosen plan covers them.

- ✅ Access to Multiple Insurance Companies – A broker looks at plans from multiple insurance companies to find the best match.

- ✅ Ongoing Support – A broker helps you understand your coverage before, during, and after enrollment, including any future changes.

- ✅ No Direct Cost to You – Insurance companies pay brokers when you enroll in a plan. However, your premium stays the same whether you use a broker or enroll on your own.

- ✅ Lower Out-of-Pocket Costs – A broker reviews different plans based on monthly costs, deductibles, co-pays, and drug prices. Their goal is to help you find the most affordable option for your healthcare needs.

- ✅ One Point of Contact – Instead of calling a random call center, you get a dedicated expert who understands your specific healthcare needs.

Medicare brokers must follow strict CMS (Centers for Medicare & Medicaid Services) regulations, ensuring they provide accurate and transparent plan comparisons.

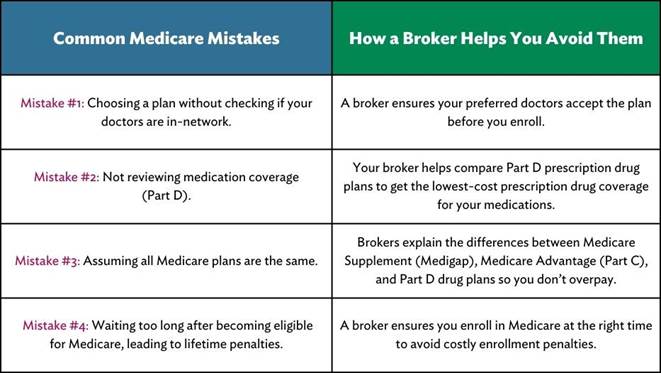

Common Medicare Mistakes (And How a Broker Helps You Avoid Them!)

Understanding Medicare Late Enrollment Penalties

Missing your Initial Enrollment Period (IEP) can lead to financial penalties that last a lifetime.

- Part B Late Enrollment Penalty – If you delay enrollment, your monthly premium increases by 10% each year. However, you won’t face this penalty if you qualify for a Special Enrollment Period.

- Part D Late Enrollment Penalty – If you go without creditable prescription drug coverage, you’ll pay a penalty. This penalty adds 1% of the national base premium for each month you don’t have coverage.

- General Enrollment Period Consequences – If you miss your enrollment window, you can only enroll during the General Enrollment Period (Jan 1 – Mar 31). Your coverage will then begin on July 1st.

Medicare Advantage (Part C) plans are NOT affected by the Part B late enrollment penalty—but you still need to enroll in Medicare Part B to qualify for a Medicare Advantage plan.

Medicare Advantage vs. Medigap: Understanding Your Choices

Many people are confused about the difference between Medicare Advantage (Part C) and Medigap (Medicare Supplement) plans. Here’s a quick comparison:

Your Medicare broker can help you decide whether Medicare Advantage or Medigap is the better fit for your needs.

Final Thoughts: Should You Use a Medicare Broker?

Most people become eligible for Medicare at age 65, but researching Medicare plans on your own can be overwhelming. A Medicare broker simplifies the process by handling the research, comparisons, and enrollment for you.

How a Medicare Broker Benefits You

✅ Saves You Time – No need to spend hours researching plans.

✅ Provides Expert Guidance – Explains the differences between Part A, Part B, Part D plans, and Medicare Advantage.

✅ Avoids Enrollment Mistakes – Ensures you don’t pick the wrong plan or miss deadlines.

✅ Gives Ongoing Support – Your broker remains available even after enrollment to help with any questions.

🎥 Want to learn more? Watch the full Medicare series with Scott Black to understand your options.

📞 Need Help? Contact Scott Black at Florida Health Resources for free, personalized Medicare guidance!

✅ Call or Text: (941) 302-0314

✅ Email: sdblack@verizon.net

HOME HELPERS OF BRADENTON

Home Helpers of Bradenton is one of the region's leading home care franchises specializing in comprehensive services for seniors. Home Helpers' sole mission is to make life easier for clients and their families. Based in Bradenton, Florida, the company serves all of Manatee County, including the communities of Anna Maria, Bradenton, Bradenton Beach, Ellenton, Holmes Beach, Lakewood Ranch, Longboat Key, Palmetto, and Parrish. For more information or to request a free in-home care assessment, contact our office at (941) 499-5946 or visit our website at www.homehelpershomecare.com/bradenton