Medicare Advantage Plans: HMO vs. PPO – Which Is Best?

Author: Home Helpers Home Care

Medicare Advantage Plans (Part C) bundle hospital, doctor, and drug coverage into one plan. However, choosing between an HMO or PPO can be confusing. Which medicare option is most suitable for your needs?

🎥 This is the fifth episode of a seven-part Medicare series on Home Helpers Water Cooler Chat. It features Medicare expert Scott Black, the owner of Florida Health Resources. In this episode, Scott explains how Medicare Advantage plans work and the key differences between HMO and PPO options.

📌 Need Medicare guidance? Contact Scott Black for personalized help!

📞 Call or Text: (941) 302-0314

📧 Email: sdblack@verizon.net

🏢 Company: Florida Health Resources

What is a Medicare Advantage (Part C) Plan?

Medicare Advantage (Part C) is an alternative to Original Medicare. It combines hospital (Part A), medical (Part B), and often prescription drug (Part D) coverage into a single plan. These plans come from private insurance companies. The federal government does not provide them.

Key Features of Medicare Advantage Plans

• All-in-One Coverage – Combines Medicare Part A, Part B, and usually Part D into a single plan.

• Private Insurance Providers – Plans are offered by Medicare-approved private insurance companies that follow Medicare’s rules.

• Extra Benefits – Many plans include dental, vision, hearing, and fitness programs.

• Lower Monthly Costs – Some Medicare Advantage plans have $0 premiums and lower out-of-pocket costs than Original Medicare.

• Network Restrictions – Routine care often requires using network doctors and hospitals, but emergency and urgent care are covered anywhere.

💡 Medicare Advantage plans can save money but may limit health care provider choices. Understanding HMO vs. PPO options is key to choosing the right plan!

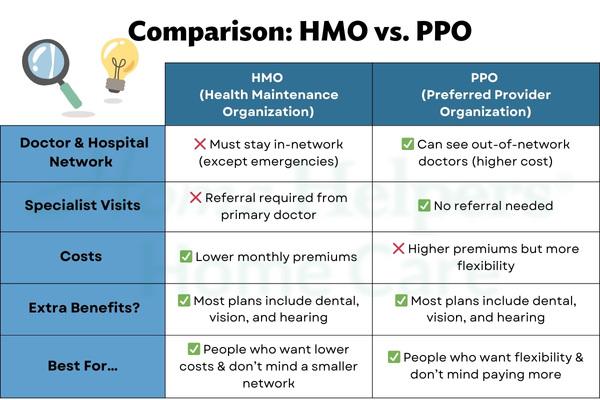

HMO vs. PPO: What’s the Difference?

One major choice when selecting a Medicare Advantage plan is the type of network. You must decide between an HMO (Health Maintenance Organization) or a PPO (Preferred Provider Organization). Each has advantages and trade-offs.

Note: An HMO has lower costs but limits flexibility. A PPO gives you more freedom but comes with higher costs.

HMO Medicare Advantage Plans: Pros & Cons

Advantages of an HMO Plan

- ✔️ Lower monthly premiums than PPOs.

- ✔️ Lower out-of-pocket costs for doctor visits and hospital stays.

- ✔️ Coordinated care – Requires a primary care doctor (PCP) to manage your healthcare.

- ✔️ Predictable costs – Fewer unexpected medical expenses.

Disadvantages of an HMO Plan

- ❌ Must use in-network doctors – Unless it’s an emergency, out-of-network care is not covered.

- ❌ Requires referrals for specialists – You need approval from your primary doctor before seeing a specialist.

- ❌ Limited provider choices – You have fewer choices if you prefer specific doctors or hospitals.

💡 Best for people who prefer lower costs, a structured healthcare network, and don’t need frequent specialist visits.

PPO Medicare Advantage Plans: Pros & Cons

Advantages of a PPO Plan

- ✔️ More flexibility – You can see out-of-network doctors and specialists.

- ✔️ No referrals needed – Go directly to specialists without waiting for approval.

- ✔️ Larger provider network – More options for choosing doctors and hospitals.

Disadvantages of a PPO Plan

- ❌ Higher premiums – PPO plans usually have higher monthly costs than HMOs.

- ❌ Higher out-of-pocket expenses – Seeing out-of-network providers costs more.

- ❌ More paperwork – This may require submitting claims for out-of-network services.

💡 Best for people who want more provider choices and don’t mind paying higher premiums for flexibility.

Who Should Consider Medicare Advantage?

Medicare Advantage plans are a good option for:

• People looking for a lower monthly premium – Many plans offer $0 premium options.

• People who want extra benefits – Most Medicare Advantage plans include dental, vision, hearing, and fitness benefits.

• People who don’t travel often – HMO plans are ideal for people who live in one area and visit local doctors.

• People comfortable with provider networks – An HMO plan may be a good choice if you’re comfortable with limited doctor options and referral requirements.

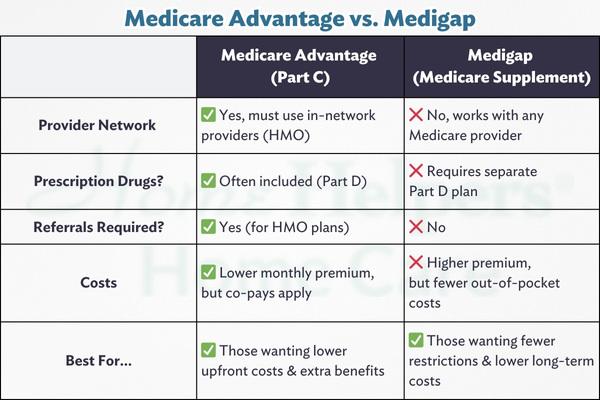

💡 If you often see specialists or travel, a Medigap (Medicare Supplement) plan may be a better choice. It offers more flexibility compared to Medicare Advantage.

Medicare Advantage vs. Medigap: Which Should You Choose?

💡 If you're uncertain about which plan is best for you, a Medicare broker can help compare your options.

Final Thoughts: Which Medicare Plan is Best for You?

Medicare Advantage is a good choice for many people. However, you need to understand network limits, out-of-pocket costs, and whether an HMO or PPO fits your needs.

Key Takeaways

- ✅ HMO plans cost less but require you to stay within the network.

- ✅ PPO plans cost more but offer more provider choices and flexibility.

- ✅ Medicare Advantage works best for people who want bundled coverage and extra benefits.

- ✅ Medigap may be better for those who travel often or want fewer out-of-pocket costs.

Why Work With a Medicare Broker?

A Medicare broker like Scott Black can:

- ✔ Compare multiple Medicare Advantage plans to find the best option for you.

- ✔ Help you decide between an HMO or PPO based on your healthcare needs.

- ✔ Explain extra benefits and out-of-pocket costs so you can make an informed decision.

- ✔ Ensure you enroll on time and avoid late penalties.

🎥 Want to learn more? Watch the full Medicare series with Scott Black to understand your options.

📞 Need Help? Contact Scott Black at Florida Health Resources for free, personalized Medicare guidance!

✅ Call or Text: (941) 302-0314

✅ Email: sdblack@verizon.net

HOME HELPERS OF BRADENTON

Home Helpers of Bradenton is one of the region's leading home care franchises specializing in comprehensive services for seniors. Home Helpers' sole mission is to make life easier for clients and their families. Based in Bradenton, Florida, the company serves all of Manatee County, including the communities of Anna Maria, Bradenton, Bradenton Beach, Ellenton, Holmes Beach, Lakewood Ranch, Longboat Key, Palmetto, and Parrish. For more information or to request a free in-home care assessment, contact our office at (941) 499-5946 or visit our website at www.homehelpershomecare.com/bradenton