How Much Does Medicare Cost? Premiums, Deductibles & Costs

Author: Home Helpers Home Care

Medicare is not free, but how much will you actually pay? Understanding the costs of Medicare premiums, deductibles, and out-of-pocket expenses is essential for making informed decisions about your healthcare coverage in retirement.

🎥 This is Part 6 of a seven-part Medicare series on Home Helpers Water Cooler Chat. It features Scott Black, a Medicare expert and owner of Florida Health Resources.

In this episode, Scott explains how much Medicare costs and how to plan for healthcare expenses in retirement.

📌 Need Medicare guidance? Contact Scott Black for personalized help!

📞 Call or Text: (941) 302-0314

📧 Email: sdblack@verizon.net

🏢 Company: Florida Health Resources

How Much Does Medicare Cost in 2025?

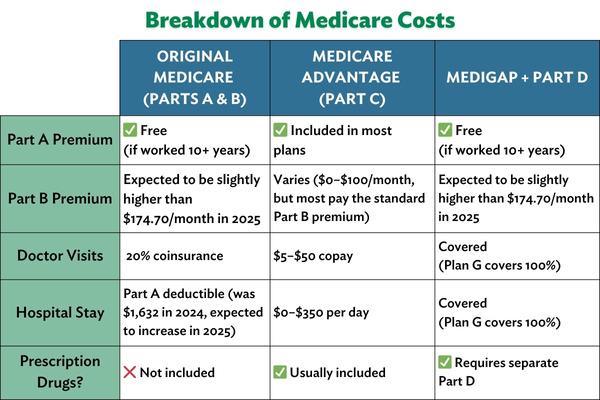

Medicare costs vary depending on the plan you choose. Here’s a breakdown of costs for Original Medicare (Parts A & B). It also covers Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans.

Understanding Medicare Premiums & Deductibles

Medicare Part A Costs (Hospital Insurance)

Most people get Part A for free if they worked for at least 10 years (40 quarters) and paid Medicare taxes. However, if you don’t qualify for premium-free Part A:

• $278/month if you worked 30-39 quarters.

• $505/month if you worked fewer than 30 quarters.

Part A Deductibles & Coinsurance (2025 Estimates):

• Hospital Stay (Days 1-60): Part A deductible (was $1,632 in 2024, expected to increase in 2025).

• Days 61-90: $400+ per day (projected increase from 2024).

• Days 91+ (Lifetime Reserve Days): $800+ per day (projected increase from 2024).

• Beyond Lifetime Reserve: Full cost of hospital stay.

💡 Medigap Plan G covers these costs 100%, making it a great option for those wanting predictable expenses.

Medicare Part B Costs (Medical Insurance)

• Monthly Premium: Expected to be slightly higher than $174.70/month in 2025.

• Annual Deductible: Was $240 in 2024, expected to increase slightly in 2025.

• Coinsurance: 20% of doctor visits and outpatient services.

💡 Medigap Plan G covers the 20% coinsurance, reducing out-of-pocket costs.

What About Medicare Advantage Costs?

Medicare Advantage (Part C) is one of the Medicare options that combines Part A, Part B, and often prescription drugs (Part D) into one plan. Private insurance companies offer these Medicare plans. The cost structure varies for each one.

• Monthly Premiums: Some plans have $0 premiums, while others charge $20–$100 per month.

• Doctor Visits: Copays range from $5–$50 per visit.

• Hospital Stays: Some plans cover hospital costs, while others charge $0–$350 per day.

• Out-of-Pocket Maximum: The 2024 cap was $8,850 for in-network care and $13,300 for combined in- and out-of-network care. The 2025 limit is expected to increase slightly.

💡 Medicare Advantage plans offer lower upfront costs, but have network restrictions and out-of-pocket caps.

Hidden Medicare Costs to Watch For

1. Late Enrollment Penalties

Higher premiums for life if you miss enrollment deadlines:

• Part B: 10% penalty per year you delay.

• Part D: 1% penalty for every month you go without coverage.

2. Medicare Part D Out-of-Pocket Cap

• Starting in 2025, Medicare will cap out-of-pocket drug costs at $2,000 per year, eliminating the Donut Hole.

• Some Part D plans now have higher deductibles (up to $590 for Tier 3+ medications).

3. Out-of-Network Costs

• Medicare Advantage plans charge higher fees if you see a doctor outside the network.

💡 A Medicare broker helps you compare plans to avoid unnecessary costs.

Medicare Costs vs. Employer Coverage: What to Expect

If you’re transitioning from employer coverage to Medicare, your costs may change.

💡 If you’re retiring, compare your employer plan to Medicare to determine the best coverage option.

Final Thoughts: Budgeting for Medicare

Medicare costs vary based on the type of plan you choose, income, and healthcare needs. Understanding premiums, deductibles, and hidden costs helps you budget effectively.

Key Takeaways

✅ Original Medicare has higher out-of-pocket costs but greater provider flexibility.

✅ Medicare Advantage usually costs less upfront, but you can only use certain doctors and hospitals.

✅ Medigap + Part D has higher premiums but fewer medical expenses. Medicare Supplement Plans, like Medigap, help cover deductibles, copayments, and coinsurance not paid by Original Medicare

✅ Late enrollment penalties can be costly, so sign up on time.

Why Work with a Medicare Broker?

A Medicare broker like Scott Black can:

✔ Compare Medicare plans based on your budget and health needs.

✔ Explain the differences between Medicare Advantage, Medigap, and Part D.

✔ Help you enroll on time to avoid penalties.

✔ Find a plan that minimizes out-of-pocket costs.

HOME HELPERS OF BRADENTON

Home Helpers of Bradenton is one of the region's leading home care franchises specializing in comprehensive services for seniors. Home Helpers' sole mission is to make life easier for clients and their families. Based in Bradenton, Florida, the company serves all of Manatee County, including the communities of Anna Maria, Bradenton, Bradenton Beach, Ellenton, Holmes Beach, Lakewood Ranch, Longboat Key, Palmetto, and Parrish. For more information or to request a free in-home care assessment, contact our office at (941) 499-5946 or visit our website at www.homehelpershomecare.com/bradenton